It is hard to believe we have already arrived in April. March was an interesting month for me because

I decided to challenge myself to try a no spend month. It was an idea I saw a lot of online in

January and as I having been continuing to work towards buying my own place at

the end of the year or beginning of next it was an idea that I kept and let

float around in my brain. I learned a

lot and found it to be a very good challenge for myself and so I wanted to

share it here.

I had been thinking about doing a no spend month for March off and on

through February as I was working on my vacation plans and budgets. I could see that to be able to do all I want

to do this year that I would need to find a way to save a little extra

money. The final straw though that set

my no spend March into motion was when I went to put some groceries away in my

deep freeze. For whatever reason it

really hit me at how full my deep freeze was, I could tell I had enough food in

it to feed a small army. As a single

person I rationally realized that I should not have a deep freeze that looks as

full as mine did so I made the decision that it was time to clean it out. The ball was rolling and I knew that in March

I was not going to buy a single thing to go into that deep freeze.

The next steps I think are what made my month such a success. The first thing I did was to create a full

inventory of the food I had in my house.

This included doing an inventory on the very full deep freeze, my

equally full pantry as well as my main fridge and freezer. This gave me a two page list of food that I

had to available for me to use, which also shocked me. I mean how many times have I stopped to pick

up fast food because I thought I had nothing to cook in my house? LOL!

Having this inventory helped me meal plan for the whole month of March

and it became a fantastic tool, I have even created a new and happily a

slightly smaller inventory for April.

The second step was to create a list of exceptions to my no spend

month, a set of rules so I knew if I was successful or not. I’m sure that aside from bills it is probably

possible to not spend at all but I know for myself that I needed to have a

little wiggle room but I also knew that if I didn’t have specific rules it

would be easy to cheat my way through the month. I thought long and hard over what would be

reasonable exceptions and these are the 4 I came up with which worked for

me. The first exception was that I could

still do dinner out on March 2 and 7.

These were pre-exisiting dates where I would be doing things right after

work so needed to be able to eat first.

The second exception could have been included with the first I suppose,

but it was that I could go for my end of month drinks with the people I work

with. The third exception was that I

could still buy fresh fruit, veggies and dairy because as much as I want to

save money, this stuff goes bad and I’m not willing to sacrifice them to prove

to myself I can stop spending. The last exception was that I could buy gas for

my car. I’m not at the point I can walk

to work and taking the bus would also cost so gas it was. Of course obviously bills were also going to

be paid but I didn’t record it as an exception because it felt like common

sense to me.

My last step was to decide on a reward.

What could I give myself if I made it to the end of the month without

spending? Well of course the obvious

answer to that was that I could use the money saved towards my vacations and my

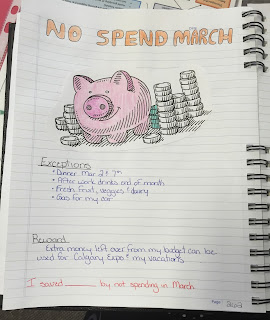

Expo weekend. With all these steps

worked through I knew I needed a way to keep myself accountable so I made a

pretty page in my bullet journal to record and document the challenge. I have learned that for me having a visual

representation is incredibly helpful and motivating. I often turned to this page during my month

so I could remind myself where I was, what I wanted and what I would get when I

finished.

With the challenge all planned out I was actually really excited for

March 1 so I could start. Once the

calendar flipped over and things got going I quickly realized that this wasn’t

going to be the easy task that I had thought it would be. Starting right from day 1, I found myself

having to confront some of my strongest cravings, desires and triggers. There were many little challenges that I

ended up having to deal with as I took on the bigger no spend challenge. Looking back now from the end of the no spend

month though I realize that each of these little challenges are not only what

taught me the most about my spending habits but they also helped to show me how

possible it is to change something if you want it bad enough.

Cravings were probably the hardest of these smaller roadblocks that I

had to face. I didn’t realize how much

of the time I tend to give into these cravings normally until I was actively

having to tell myself no. Everything

from wanting to pick up A&W after a long day or grabbing popcorn at a movie

or non-food related cravings like buying movies or books as soon as they are

released were things I had to fight against in March. I did expect that I would have food cravings

so this wasn’t surprising . I have also

become fairly good at dealing with these from working to lose weight but what

did surprise me was how hard the desire to buy certain books or movies

was. I never would have thought of them

as cravings before but after last month I can see that they certainly can

be. How I dealt with these cravings,

food and otherwise, was to remind myself that giving this stuff up even

temporarily would help me be able to get closer to my longer term goals. Knowing that if I don’t go to A&W I would

have an extra $15 to go towards buying my John Cusack photo op for example was

a very good incentive. The other thing I

reminded myself especially for the non-food cravings was that if I still wanted

the movie or book or whatever at the end of the month then I will have money to

be able to buy them with. What I didn’t actively

realize at the time was that this is just another way of using the whole

concept of reframing. Reframing is a

tool I have been using for a while now when it comes to my weight loss but not

something I had really applied to other aspects of my life. It is a powerful

tool in training your brain to do something different than you have always done

it. It also reminded me that if I stop

and think about something and take impulse out of it I will typically make

better decisions or at the very least make a more informed decision.

The other challenge that was also hard was changing how I shopped. I am horrible for going to get groceries and

leaving with a whole bunch of items that were never on my list to start

with. Typically when I shop I walk up

and down all the aisles and see what’s on sale as I pick up the items on my

grocery list. This I now realize is a

huge mistake for me. If I see it on sale

and I know it’s something I will use or use often it ends up in my cart. Sure I might save a little bit but if I don’t

actually need it at that moment is it really saving me money or is it just

taking up space in my house? Not only

that though, as I’m wandering up and down those aisles, I also have to go past

a lot of foods that I don’t need but that I think I want (chips, chocolate, etc.). These have often ended up in my cart just

because I’m walking past them and if I’m already spending money already it’s

easy to justify a couple dollars more on that bag of chips because it’s only a

couple dollars more. Typically my weekly

grocery bills were running about $100 a trip.

I have been doing this for years and it is built in my budget so that I can

afford it. What I realized though over

the last month is that I actually don’t need to be spending that much money on

groceries. Over the month of March my

average grocery bill was always between $30 and $40. Even adding meat and other items back in I

should not have to spend $100 per week to feed myself. It was really eye opening to see this and to

realize how much money I could be saving with a tighter grocery budget.

The month wasn’t all hard though.

I had some positive surprises come out of the month too. The first was the amount of time I saved when

I went grocery shopping. With all the

hobbies, commitments and activities I have on my plate, time is probably just

as valuable as money. My weekly grocery

shopping trips went from being an hour or more down to being able to be in and

out of the store in 30 minutes or less. I

always went in with my list and because I was only buying fresh produce and

dairy I had to hit two spots and then I was good to go. It was amazing.

The other surprise was that I could actually make treats last. One of my last grocery trips in February I

had picked up a bag of sweet potato chips.

Anyone that knows me will probably tell you that I don’t buy potato

chips in any form because when they are in my house I have no will power for

them. If they are in my house they will

be eaten within a day or two. Knowing

that this bag of chips had to last me for a month before I could buy any more,

meant that I was much more careful about how much and how often I let myself

have them. And in fact I still have

enough in the bag to enjoy with a burger later on today. I’m very pleased with this. I still don’t think chips will ever be

something I regularly bring in my house but it is nice to know that I might

actually be able to deal with them in moderation if I want.

All the challenges and surprises aside I guess what probably matters

the most is the results. Overall I’m

extremely happy with the month and how it turned out. Just in terms of money, I ended up saving a total

of $377.58 in my budget jars. I was

hoping for around $500 but I’m really happy with the amount I did save. Also in terms of money I am super happy to

report that my entertainment jar and my miscellaneous jar went from being in

the red at the start of March to each actually having money in them so that I

can use them again going forward. What

is probably going to seem a little surprising when it comes to the money saved

though is that although my plan was use that money as a reward to go towards my

vacations and Expo I have actually decided to hold on to it and just see if I

can keep adding to it. The budget I worked

out at the beginning of the year will give me enough money to do my vacations

and to do at least some of the photos and autographs that I want at Expo so

that almost $400 saved will probably be better used by saving it for something

else in the future (possibly a new laptop).

The importance of saving extra money notwithstanding, I also discovered

some other amazing secondary results that came out of this challenge. The first is that I have a pantry that I can

see in and actually be able to put things away in. It feels amazing to see a clean and organized

pantry which makes cooking a lot more enjoyable and easy. The second is that I actually lost a little less

than 3 pounds this month. I’m not really

surprised by this because I did expect that with not eating out as much and not

buying treats at the grocery store that I should see some weight loss results

but it’s still pretty amazing to look back on the month and see it actually

happened.

After all the work I put into saving money in March the real question

is what’s next? As March was winding

down I started to think about what I was going to carry forward with me into

April from this challenge. The first

thing is that at least in a modified version, I’m going to be continuing with the

no spend idea. I still have a pretty

full freezer and I want to keep using it up so at least for the month of April I

still have no intentions of buying anything that needs to go into my

freezer. I have also decided to make

some permanent changes in how I deal with eating out and grocery shopping. At the start of each month I’m going to

decide what days I’m going to treat myself to dinner or lunches out so that I

don’t just do it whenever the mood strikes me.

I am also going to be limiting my grocery shopping a bit. The first grocery trip of the month will

include a list of anything that I need/want for the house but after that for

the remainder of the month I will be sticking to just fresh fruit, veggies and

dairy.

As I enter into the month that I know will be one of the most

expensive, with the exception of September when I go on a cruise, I’m excited

to know that I have better control on my spending. I’m pleased with how March turned out. I look back on the month and don’t feel like

I really missed out on anything because I was watching my money. I still got to do a lot of things that I love

as well as spend time with people I love.

I do feel like I gained a great deal of information about myself and how

I spend my money. I also feel like I

gained a little more confidence knowing that I can challenge myself and not

only rise to the challenge but be successful at it. I highly recommend everyone to try a

challenge like this and I’m super excited because I know at least two of my

friends are trying a no spend April. I

hope that they find it as useful and eye opening as I found my month.